mississippi vehicle sales tax calculator

In mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle. Motor vehicle titling and registration.

Capital Gains Tax Calculator 2022 Casaplorer

635 for vehicle 50k or less.

. For additional information click on the links below. If you are unsure call any local car dealership and ask for the tax rate. 40 feet and over.

You pay tax on the sale price of the unit less any trade-in or rebate. 1851 state local and single article Non-vehicle items. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city.

- Select this method if you know the MSRP and Model Year of your vehicle. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. You pay tax on the sale price of the unit less any trade-in or rebate.

Registration fees are 1275 for renewals and 1400 for first time registrations. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Mississippi local counties cities and special taxation districts. 2000 x 5 100.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. 425 Motor Vehicle Document Fee. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city county.

Registration fees are 1275 for renewals and 1400 for first time registrations. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Cities andor municipalities of mississippi are allowed to collect their own rate that can get up to 1 in city sales tax.

When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. Vehicle Tax Costs. This level of accuracy is important when determining sales tax rates.

You can find these fees further down on the page. Total sales price of items not included in vehicle sales price 2950 Total Tax Due on Non-Vehicle Items. - Select this method if you have your last tag receipt.

Mississippi vehicle sales tax calculator. Seller shall remove license plate from the vehicle and surrender the tag and receipt to the tax collectors office for credit towards another tag or a certificate of credit. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Taxing district in which the tax levy is 11772 mills. Find your state below to determine the total cost of your new car including the.

Dealership employees are more in tune to tax rates than most government officials. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Once you have the tax.

The city of Jackson Mississippis state capital collects its own additional sales tax of. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Our calculator has been specially developed.

In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. 1000 - If the Tax Collectors Office completes the Title Application 300 - Mail fee for tag and decal 5 - Use Tax if the vehicle is purchased from an out of state dealer.

Estimate Vehicle Tag - Hinds County Mississippi For information concerning the total revenues generated from the sale. Car tax as listed. 11772 Mills 11772 True Value- 75000 Class II Rao- x 15 Assessed Value- 11250 Mill Rate- x 11772 Tax Bill- 132435.

View a detailed list of local Sales Tax Rates in Mississippi with supporting Sales Tax Calculator. One of a suite of free online calculators provided by the team at iCalculator. Vehicle tax or sales tax is based on the vehicles net purchase price.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Choose one of the following methods to enter the value of your vehicle. Sales tax on cars and vehicles in Mississippi Fee Schedule.

The average Sales Tax rate in Mississippi in 2022 is 7. These fees are separate from the taxes and. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle.

For vehicles that are being rented or leased see see taxation of leases and rentals. There is a single statewide sales tax of 7 in Mississippi. Mississippi has a 7 statewide sales tax rate but also has 177 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0051 on.

Please call the office IF HELP IS NEEDED. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Home Motor Vehicle Sales Tax Calculator.

This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Calculate the tax bill. 27288 Total tax due on vehicle purchase 204388.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Its fairly simple to calculate provided you know your regions sales tax. 775 for vehicle over 50000.

Calculating Sales Tax Summary. It is the same everywhere in the state with a few exceptions. 2950 x 925 State and local tax 27288 note full 1800 from warranty is subject to local tax Vehicle.

Motor Vehicle Ad Valorem Taxes. Sales and Gross Receipts Taxes in Mississippi amounts to 53 billion. Mississippi Sales Tax.

It is 6499 of the total taxes 81 billion raised in Mississippi. Motor vehicle title. In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Car Tax By State Usa Manual Car Sales Tax Calculator

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

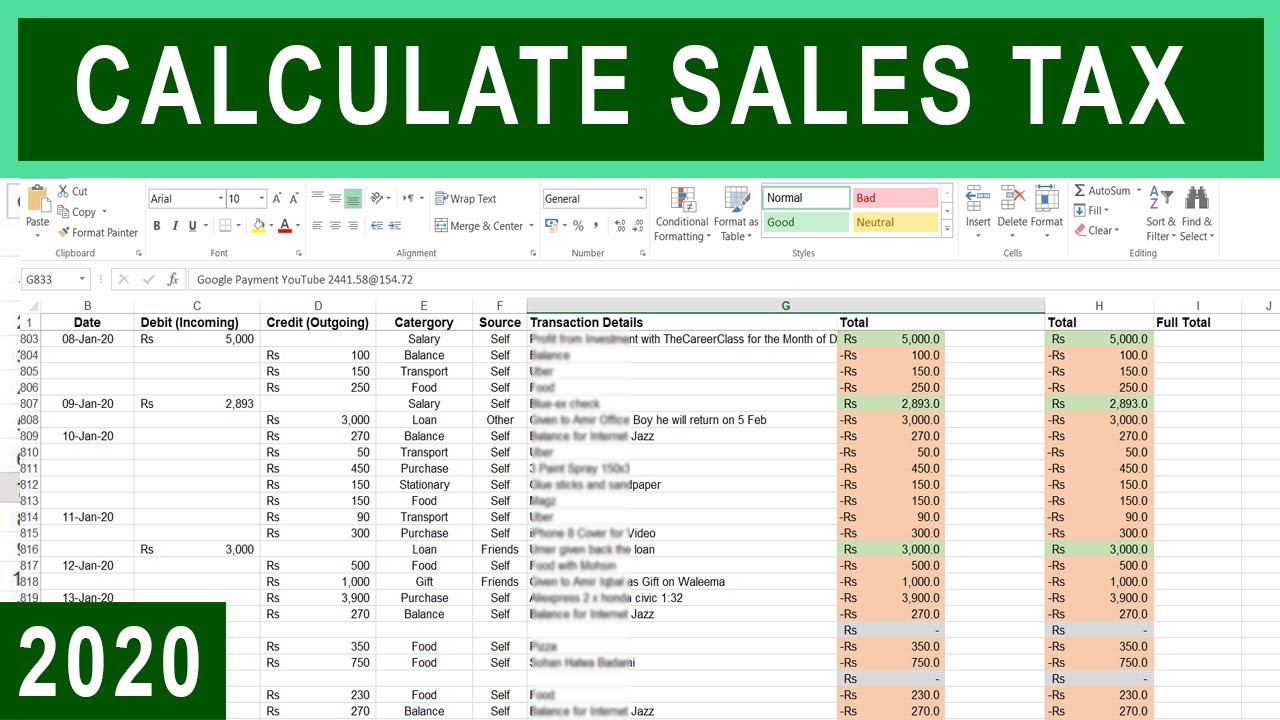

How To Calculate Sales Tax In Excel

Sales Tax On Cars And Vehicles In Mississippi

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Dmv Fees By State Usa Manual Car Registration Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Which U S States Charge Property Taxes For Cars Mansion Global

What S The Car Sales Tax In Each State Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

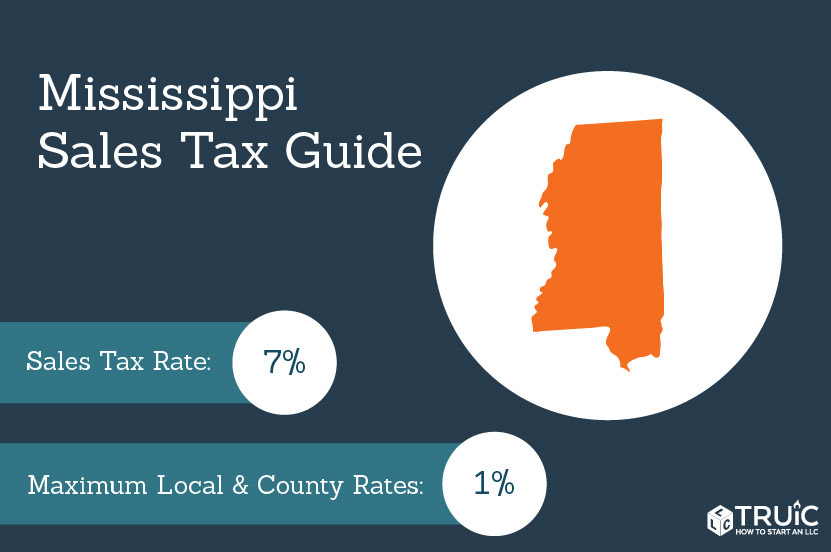

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Calculate Sales Tax Video Lesson Transcript Study Com

Mississippi Sales Tax Small Business Guide Truic

How To Calculate Sales Tax In Excel

Nj Car Sales Tax Everything You Need To Know